Background

During 2021-2022, the banking faced unprecedented challenges due to the COVID-19 pandemic. As

lockdowns and social distancing measures significantly impacted the efficiency of physical

branches, there was an urgent need to adapt to the accelerating pace of digitalization.

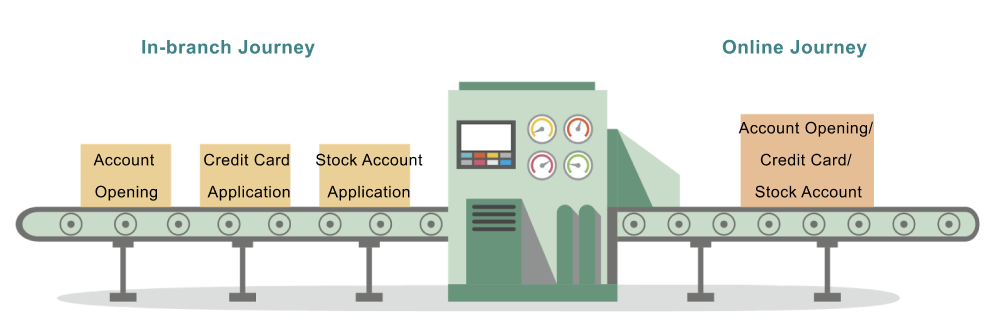

This project aimed to redesign the online bank account opening process to enhance customer

satisfaction and accessibility. This was achieved by integrating online and offline experiences

throughout the account opening journey.

Roal

As a UX/UI Designer in CI design team, my responsibilities encompassed collaborating closely with cross-functional teams to gather insights, conceptualize design solutions, and execute the creation of wireframes and prototypes tailored for optimal usabiliy.

Goal

The goal was to integrate online and offline experiences, facilitating a seamless transition from digital interactions to in-person appointments. Additionally, there was an effort to streamline the process for customers, enabling them to open multiple accounts—from stocks and savings to credit cards—via a unified and user-friendly interface.

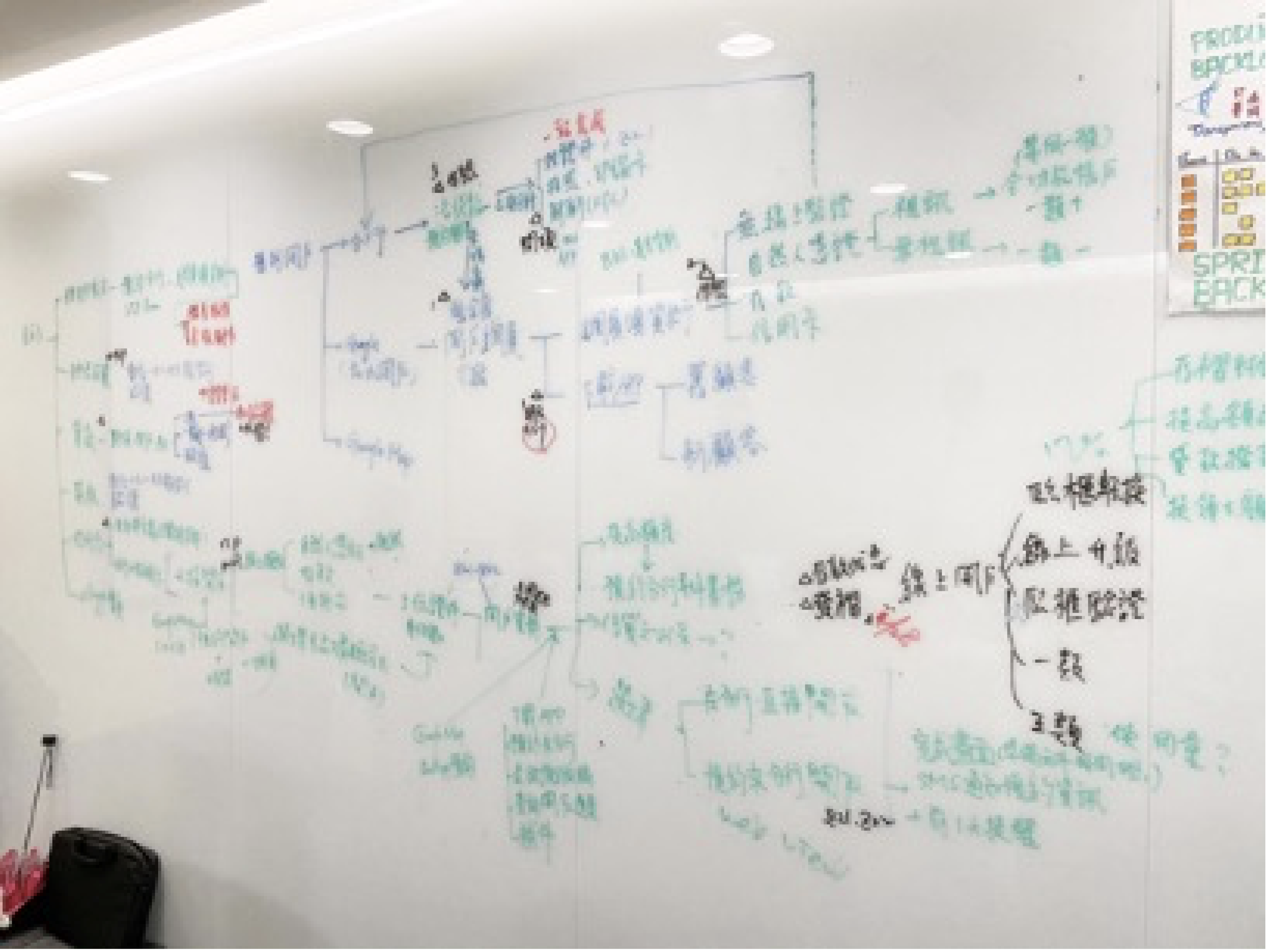

Brainstorming

During the brainstorming phase, we thoroughly analyzed existing processes and collaborated with stakeholders from various departments, including UX Reaserch team, managers from the digital development team, stock department, credit card department, legal department, and others, to gather requirements and insights.

User Journey Map

Based on the research and Analysis,we identified the key touchpoints in the user journey, from initial awareness to account activation. This involved understanding the various stages users go through, including awareness, research, initiation, account opening, document submission, verification, appointment scheduling, in-person appointments, account activation, and feedback/support.For each touchpoint, we mapped out the actions users take and the emotions they may experience.

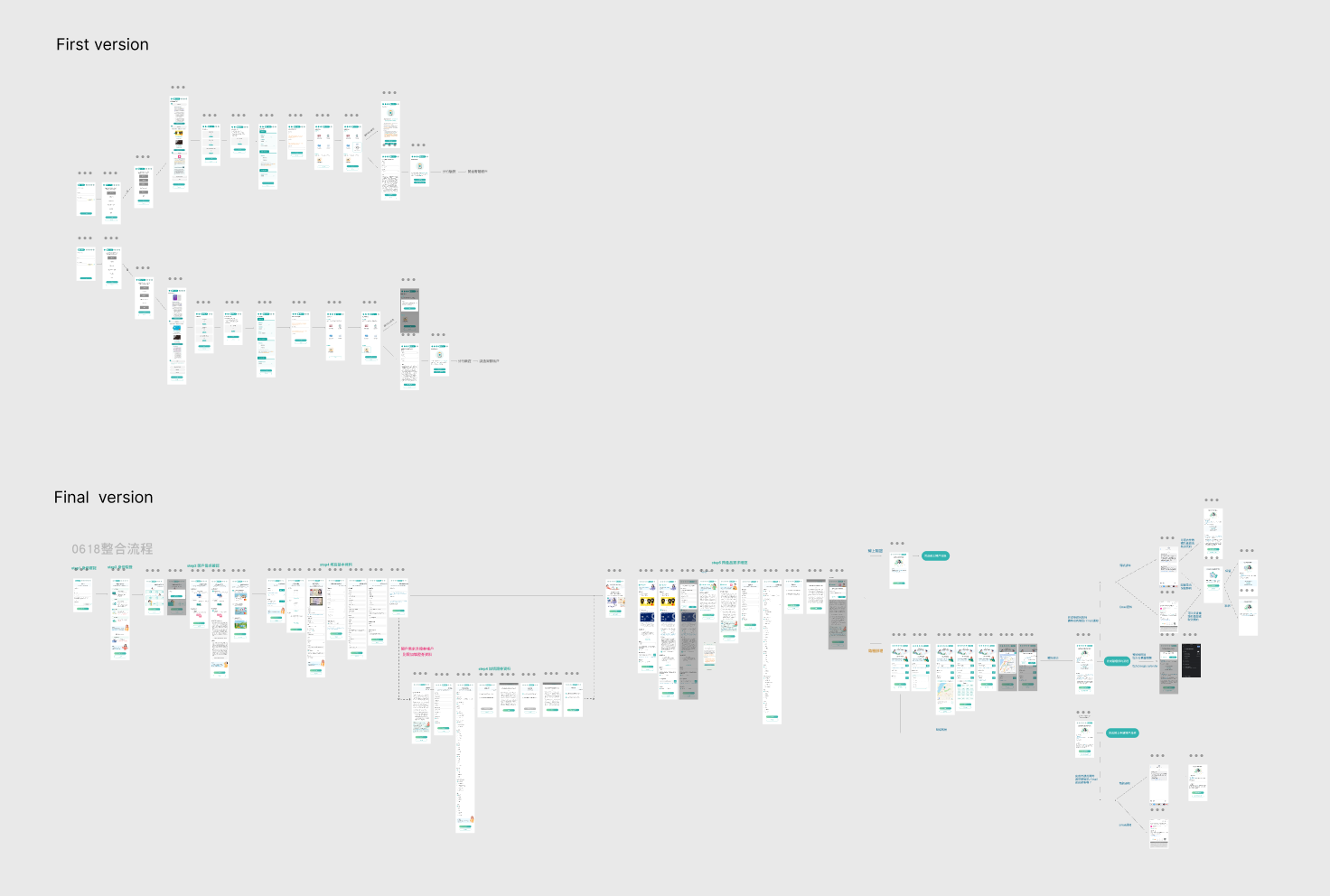

User Flow and Wireframe

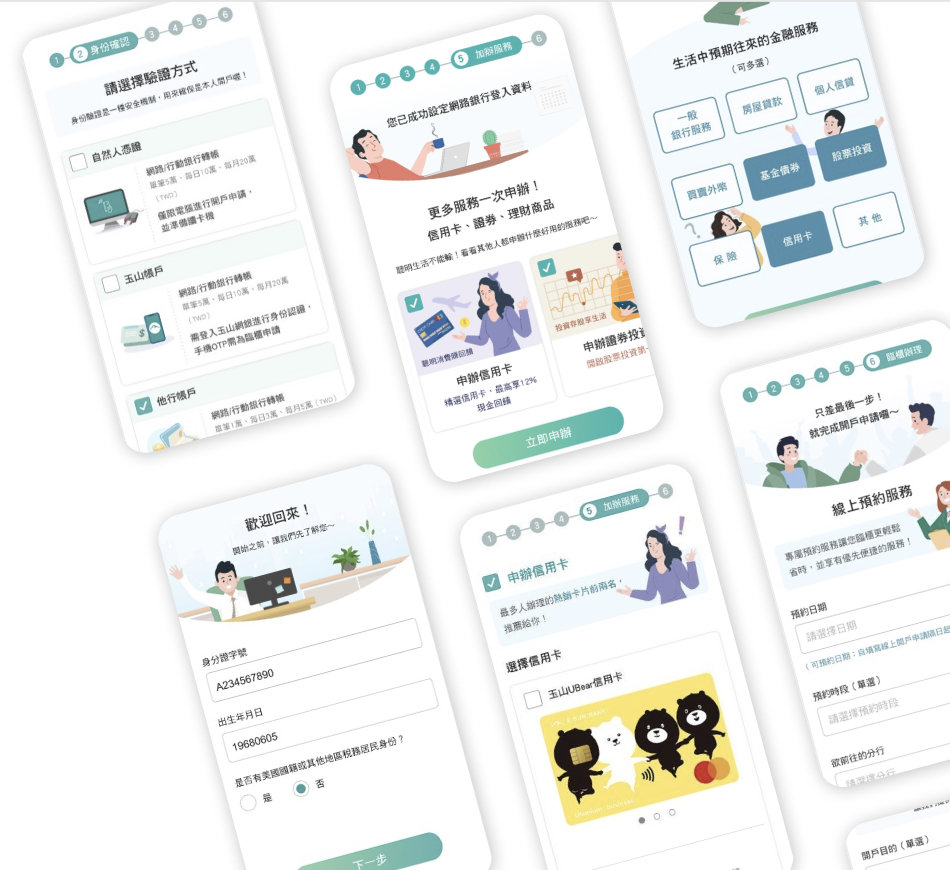

We crafted a wireframe to offer a concise visual depiction of the new process, enabling stakeholders to review and offer feedback on the proposed design. This user-flow and wireframe underwent multiple iterations through feedback and testing to ensure it not only seamlessly integrates online and offline experiences, with smooth transitions between digital interactions and in-person appointments but also align with business goal and legal procedures.

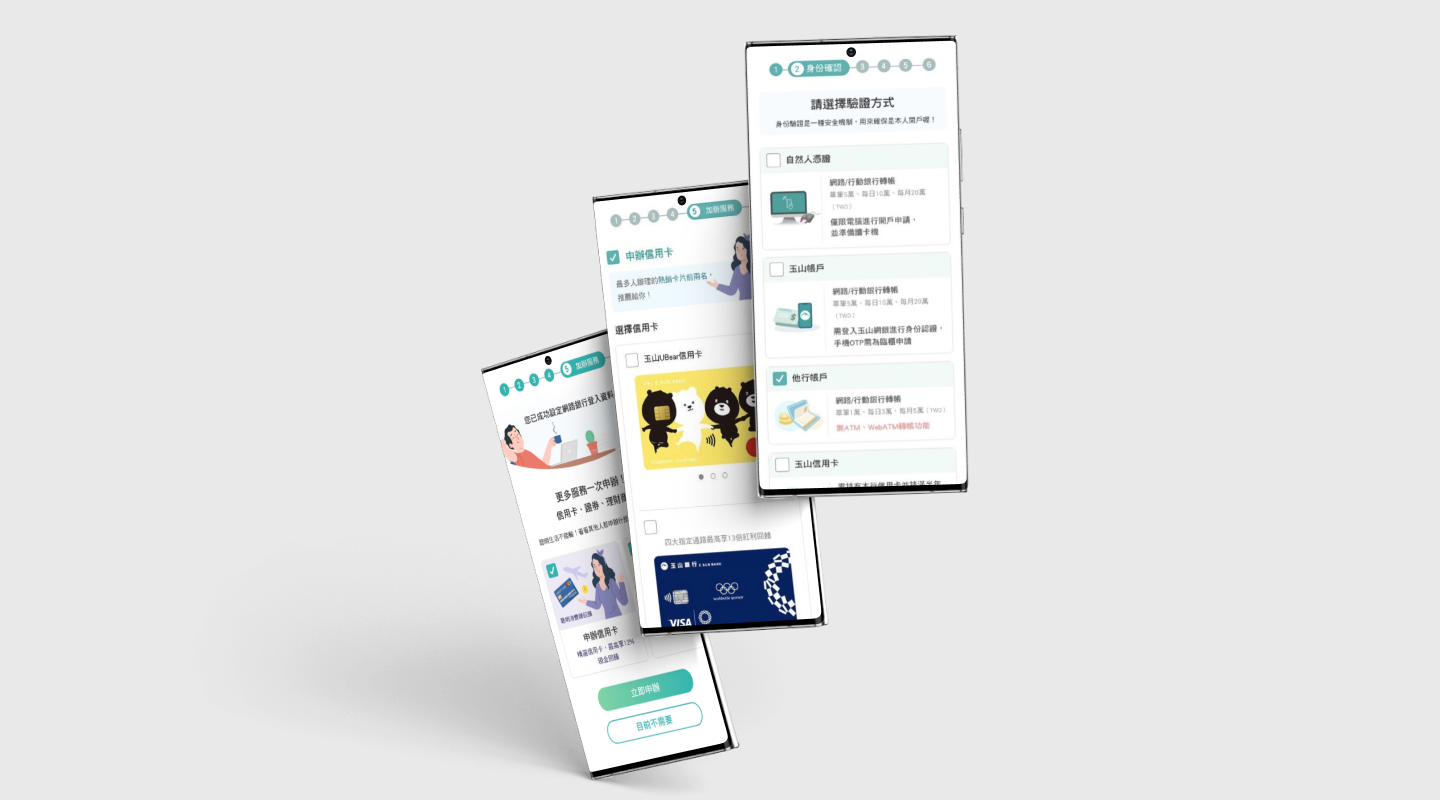

UX/UI Design Solution

To emulate the personal and conversational experience customers typically encounter in a physical branch setting, we strived to recreate the warmth, engagement, and personalized attention that customers receive when interacting with bank representatives face-to-face. To achieve this, we focused on:

We tailored the experience to each user's needs and preferences, offering personalized recommendations, guidance, and support based on their input and behavior.

Mockup

Outcome

Following the proposal's acceptance by the product team, the new account opening process was officially launched to the public in August 2022. The successful launch marked a significant milestone in the project's journey towards improving customer experience and driving digital transformation within the bank.The implementation of the revamped online bank account opening process yielded several key outcomes:

Any question or remarks? Feel free to Email me! 📧

jeanzu19@gmail.com